%20(1).avif)

The Cusp

The Sustainability pendulum is swinging back – or is it?

A growing narrative suggests that sustainability – or ESG – has lost its relevance, dismissed as either an outdated corporate ideal or a product of partisan excess. Among skeptics, ESG is bureaucracy by another name: an obstacle to getting business done.

Yet this view overlooks a simple reality: Environmental, social and governance issues continue to shape markets and industries in ways that directly affect business outcomes. Energy security, supply chain resilience, regulatory shifts and changing customer expectations are not abstract debates - they continue to reshape industries and business models, while creating opportunities for companies.

The current turbulence around the acronym (ESG) represents not the end of ESG, but rather the prelude to a transformative new era of sustainability. The foundational forces driving the necessity of ESG are intensifying by the day. Decision-maker attention may fluctuate, but the pendulum is poised to swing back. The next wave of sustainable opportunities will (finally) be defined by materiality – and in essence, it does not matter whether one refers to the acronym “ESG” (as an attempt to concretize sustainability) or not, since the focus must be placed on the respective material issues. When sustainability initiatives are tied to the real drivers of business performance (including but not limited to cost, risk, revenue, talent and innovation) they stop being a moral overlay and become engines of value creation. At Cusp Capital, we focus on backing those companies where this dynamic creates long-term value.

Foundational drivers: Getting stronger by the day

The world continues its path from narrow-mindedness to comprehensive opportunity in the field of sustainability (ESG – Environmental, Social, and Governance). Sustainability means a pronounced readiness to reap the future to its fullest extent. Too often a perspective that is excessively short term and narrow overlooks the harm done – and chances overseen – in respecting our environment, protecting the rights of workers, and implementing strong corporate governance structures. Empowering all stakeholders entails massive opportunities in the long run.

The mass-production era introduced the current linear economic model of producing, using, and disposing. With increasing financialization and digitization, nearly every aspect of our world has become transactionalized – what can be measured, priced, and transacted will be.

Environment

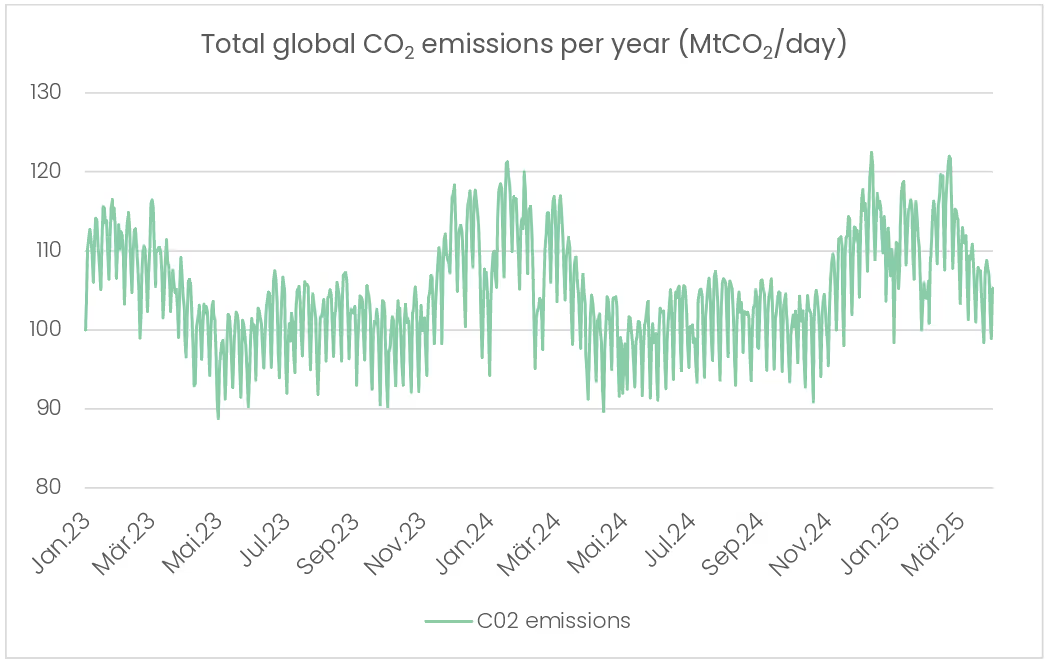

Environmental concerns continue to aggravate. Climate change creates a systemic risk that threatens the very foundation of businesses and humankind. More and more extreme weather events – like floods, hurricanes, and wildfires – are affecting countries all over the world. Although these disasters haven't caused systemic financial instability yet, experts are beginning to seriously rethink the economic impacts of climate change (FT, Clark, 2025). Companies have stimulated customer purchases in ever shorter cycles. Today’s average American buys a new piece of clothing every five days; by 2030, the apparel industry’s global emissions are expected to rise 50% (Earth.org 2023). This dynamic is not confined to fashion: total global CO2 emissions across industries have also remained on their highly expansionist path when corrected for seasonal fluctuations as the following graphic shows:

Social

Societal pain points are also intensifying, with growing evidence of strain across labor markets and broader social systems. In the OECD, widening talent shortages and declining employee tenure point to structural imbalances in labor conditions. The persistence and in some regions, the rise of forced labor further underscores these systemic vulnerabilities. The following graphics provide granularity on these trends:

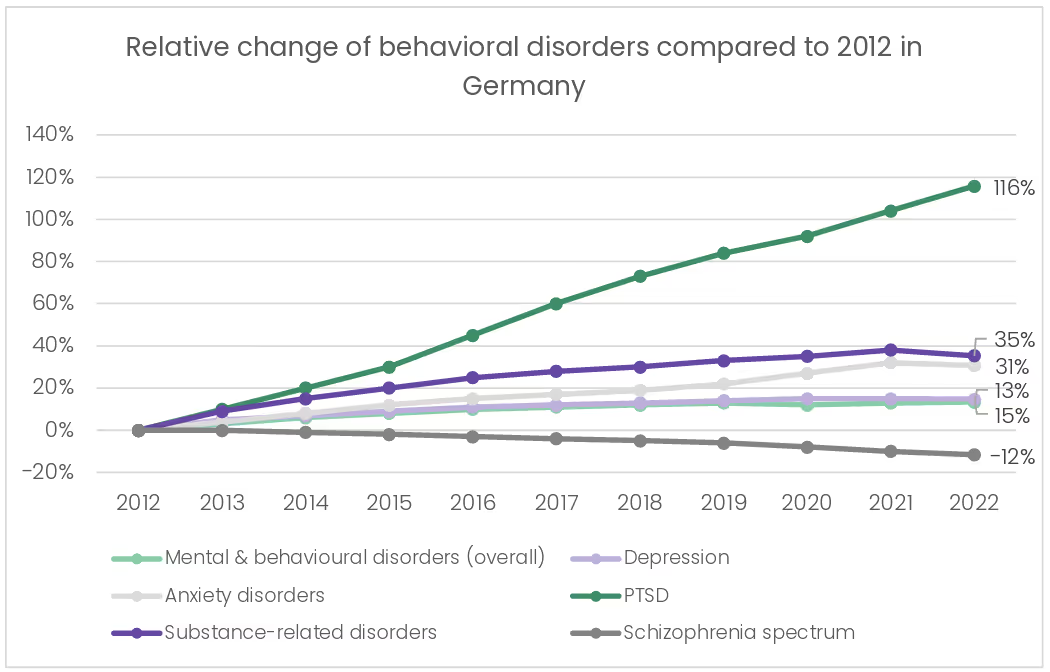

At the same time, society’s social challenges are also evident in an ongoing erosion of mental health. In Germany, for example, diagnoses of mental and behavioral disorders overall have increased by 13.4% in the ten years since 2012 as illustrated in the following graphics2.

Ongoing demographic shifts threaten to exacerbate these social strains. Older workers, in particular, face disproportionately high risks of unemployment and wage loss when changing jobs, while employers grapple with rising recruitment costs and diminished productivity due to increased turnover. Together, these trends highlight the mounting societal challenges that transcend standard economic indicators. They underscore the need for coordinated policy interventions, innovative workforce strategies, and rigorous due diligence practices to safeguard both workers and sustainable growth.

Governance

Governance pressures are intensifying, and the way in which firms are directed and supervised has never been more consequential. In contemporary markets, much of corporate value resides in intangibles – software, data, algorithms, and intellectual property – deployed across globally distributed networks of data vendors, contract manufacturers, and logistics platforms. Even when the final product is physical, the control plane is digital: code and data thread through multilayered supply chains, so that a single point of weakness can cascade across systems and counterparties within hours.

In earlier, asset-heavy economies, products evolved infrequently, and operational failures tended to be local and reversible. Today, however, release cycles are continuous, decision-making is increasingly model- and data-driven, and third-party dependencies are pervasive. Superimpose on this environment the destabilizing effects of geopolitical shocks, regulatory fragmentation, AI and stochastic model risk, and governance emerges as a core performance system, not an audit ritual.

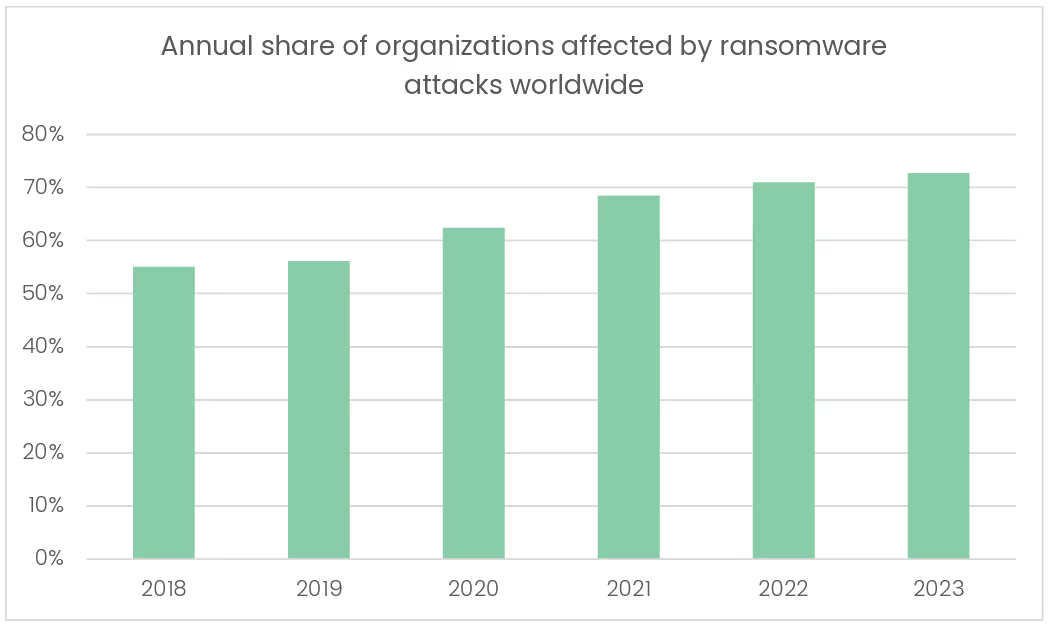

Cybersecurity illustrates this transformation vividly. In the absence of robust governance and control systems, organizations face escalating threats that are at once more frequent, more sophisticated, and increasingly automated. Voice phishing (“vishing”) attacks, for instance, surged by 442% between the first and second half of 2024 (CrowdStrike 2025). Likewise, the proportion of organizations compromised by ransomware has risen steadily every year between 2018 and 2023.

The trajectory is unambiguous: governance pressures will only accelerate as generative AI enables deepfake-based attacks at scale, fundamentally testing the adequacy of prevailing oversight frameworks.

The Fundamentals hold

The foundational drivers of sustainability outlined above – escalating environmental risks, deepening social strains, and mounting governance pressures – are not peripheral to business and finance. They are the foundational drivers that increasingly dictate competitiveness, and resilience. Put differently: what once looked like externalities are today becoming core inputs into long-term financial performance.

This is where fundamentals and sustainability intersect. To illustrate, we can use the Capital Asset Pricing Model (CAPM) as a mental proxy3 to demonstrate how sustainability creates value.

E[Rᵢ] = Rf + βᵢ · (E[Rm] − Rf)

It links expected equity returns to priced risk: the risk-free rate, the market risk premium, and a firm’s beta. Framed this way, sustainability is not an overlay but a set of operating choices that change what investors require as return.

Decomposing the CAPM

- Risk-free rate Rf. Largely exogenous to any one firm, but at the system level credible transition and resilience policies can shift baseline macro risk. Treat this as context, not a primary lever for a single issuer.

- Market risk premium E[Rm] − Rf. Climate damage, policy volatility, and technology diffusion can widen or compress the aggregate premium over time. Again, more macro than firm-specific, but it sets the price of risk your beta loads on.

- Beta β - where firm actions bite. By definition, β measures how a firm’s cash flows co-move with market shocks. Environmental exposures (carbon and energy intensity, physical and transition risks), social/operational fragility (labor instability, single-sourced supply chains), and governance/technology gaps (product safety, cyber/model risk) increase covariance with common shocks and push β up. De-risking those channels (e.g. long-dated clean energy inputs, resilient workforce practices, multi-sourcing, strong cyber and product governance) reduces shared sensitivity, lowers β, and therefore lowers the required return on equity in CAPM. Empirically, firms that invest in ESG to strengthen differentiation and resilience exhibit lower systematic risk and higher value, consistent with this mechanism. (Albuquerque, 2019)

- Cash-flow channel (beyond CAPM). Stronger ESG often stabilizes and sometimes increases free cash flow (fewer outages, legal losses, or catastrophic events). Even holding β fixed, steadier cash flows support higher valuations.

The logic extends to cost of debt: lenders charge higher loan spreads and bond demand wider yields for firms with poor environmental/social/governance profiles, while better corporate sustainability performance is rewarded with cheaper debt and stronger credit ratings. (Flammer, 2021)

Sustainability is not just about doing good; by lowering perceived risk and stabilizing growth trajectories, strong sustainability, with a focus on material issues, reduces the cost of capital and accelerates venture-scale returns. (MSCI, 2024) Because these mechanisms are structural – manifesting directly in beta and credit spreads – they persist regardless of shifting headlines. In other words, the fundamentals of sustainability are not contingent on the swings of the attention pendulum; they remain constant even as the spotlight shifts.

Structural Sustainability Beyond Attention: From Risk Mitigation to Value Creation

The fundamentals of sustainability are structural and persist independently of short-term fluctuations in sentiment. Within the framework of the Capital Asset Pricing Model (CAPM), sustainability reduces systematic risk exposure by lowering covariance with market shocks. At Cusp Capital, however, we posit that material sustainability extends beyond this de-risking function: it represents a direct driver of value creation. Accordingly, we anticipate that the pendulum of attention will swing back - with a sharper focus on materiality than in previous cycles - regardless of whether decision-makers reorient their priorities. The initial wave of sustainability adoption was predominantly compliance driven. Firms introduced ESG frameworks to meet regulatory reporting requirements, largely independent of whether these frameworks were conceptually coherent or financially material. Because such compliance oriented initiatives failed to generate measurable improvements in shortterm corporate performance, overall enthusiasm eroded and eventually gave rise to societal and political backlash. In counterfactual terms, had ESG efforts been anchored in materiality - directly enhancing operational performance and competitiveness - the pendulum might have remained closer to its apex rather than reversing direction.

The current phase of reduced attention does not eliminate the strategic relevance of sustainability; it redefines its operational locus. In a more deregulated environment, companies are unlikely to allocate resources to symbolic or purely reputational gestures. Instead, they concentrate on sustainability levers with demonstrable economic impact: either expanding the top line through differentiated products, services, and markets, or reducing costs through efficiency, resilience, and resource optimization. This transition constitutes a distinct space of opportunity. Firms that successfully combine the immediate financial benefits of material sustainability with long-term resilience and risk reduction are positioned to outperform their peers and secure a durable competitive advantage.

Importantly, this trajectory is not contingent on cyclical fluctuations in attention. sustainability initiatives demonstrably improve competitiveness, they become embedded in corporate strategy as structural drivers of performance. Over time, such material approaches induce renewed attention and reinforce the pendulum’s motion. In this sense, the pendulum swings not because of sentiment or regulation per se, but because fundamentals necessitate it. The material dimension of sustainability thus delineates the next frontier of long-term value creation.

The Opportunity: The Materiality side of ESG

As ESG considerations become increasingly central to business strategy, the focus is shifting from superficial sustainability initiatives to those that create tangible, measurable value. What will not work anymore: Sustainability initiatives that serve solely to enhance reputation or build brand image. What will Visualization of ESG Materiality (Cusp Capital, 2024) thrive are solutions that deliver immediate and measurable value (ROI) and address material ESG risks and opportunities. This is the Materiality side of ESG. The concept of materiality - identifying and prioritizing the ESG factors most significant to a company, its stakeholders, and the environment - now defines the new frontier of sustainable business opportunity. Material factors are not universal; they vary by industry, geography, and company context.

The three pillars of ESG Materiality:

1. Environmental Materiality

In the Environmental arena, materiality factors often pertain to climate change and resource management. Regulatory changes imposing carbon taxes or stricter emission limits can increase operational costs for companies not managing their carbon footprint. Extreme weather events related to climate change can disrupt supply chains. Scarcity of resources like water or raw materials can lead to increased costs. Consumer demand for sustainable products can shift market dynamics.

Strategic Response: Forward-thinking firms are moving from merely reporting climate-related issues (i.e. losses) to implementing proactive risk management and resilience strategies. Prevention and adaptation, rather than damage control, are key to minimizing long-term losses. Achieving this requires decision-makers to adopt long-term perspectives in their incentive structures.

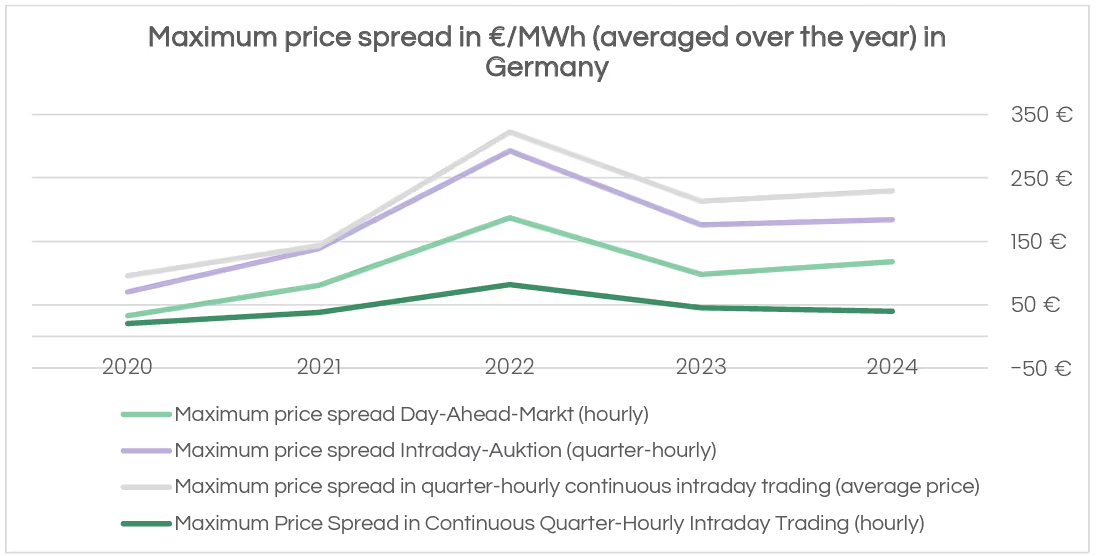

Material Example: Europe’s unfolding energy transition – with its concurrent technical, economic, and policy challenges – falls particularly on electricity grids and constitutes a paradigmatic instance of material sustainability. Although projections of the ultimate share of renewables in the energy mix are frequently revised - driven by technology cost curves, geopolitical events, and legislative revisions - the primordial forcing variable, anthropogenic climate change, remains unchanged. Consequently, renewables delivered roughly 47% of EU gross electricity in 2024 (Eurostat, 2025), catalyzed by sector-wide electrification, the widespread deployment of distributed energy resources, and the inexorable rise of wind and solar in the energy mix. These dynamics necessitate a first-principles redesign of electricity markets and grids across voltage levels and impose significant system-wide strain – manifest in elevated prices and unprecedented volatility – on the energy sector and, by extension, on companies (see figure below).

While this volatility poses significant challenges for companies, it simultaneously generates substantial opportunities. By leveraging existing electrical assets and unlocking operational flexibility, companies can not only reduce electricity expenditures by shifting idle capacity to cheaper periods

but also, in certain industries, monetize their flexibility by participating in gridbalancing markets. In some cases, this can offset up to 50% of total electricity costs, all while enabling the use of a higher share of renewables through demand shifting. Volatility thus becomes not only a risk to be managed but also a material sustainability opportunity: it allows companies to lower costs, enhance resilience, and contribute to a sustainable and resilient electricity market.

At the same time, these dynamics unlock investable white spaces – from AIorchestrated flexibility exchanges to probabilistic dispatch algorithms and demand-side steering platforms – that address these volatility challenges, fortify grid resilience, and enable a sustainable energy transition. Companies that focus on unlocking this dimension of environmental sustainability not only expand the renewable share in the energy mix and contribute to securing a resilient, stable grid; they also position themselves to capitalize on this paradigm shift by emerging as meaningful new market players, thereby demonstrating how sustainability can be effectively aligned with tangible financial impact.

2. Social Materiality

When it comes to Social, materiality resides in labour practices and community impact. Poor labour conditions can lead to strikes, high staff turnover, and reputational harm, all of which affect operational efficiency and brand value. Negative effects on local communities may trigger legal challenges, protests, or loss of license to operate. Ultimately, human capital is a company’s most valuable resource; protecting and compounding it through fair pay, safe conditions, and upward mobility is a direct driver of productivity, resilience, and long run enterprise value.

Strategic Response: Solutions that put the needs and interests of lower-wage workers and lower-income consumers front and center (see also our Lower-Income hypothesis).

Material Example: Earned Short-term liquidity mismatches among lowerwage workers – when bills arrive before payday – are a first-order “S” materiality driver because they show up as churn, absenteeism, and service instability. Employer-integrated Earned wage access, which lets employees draw down a capped portion of already-earned wages, directly targets that friction and strengthens attachment: a Harvard Business School study using employer-linked data from Minu (Mexico) finds EWA usage is associated with higher near-term retention and persistently lower quit risk after rollout (Harvard Business School, 2022). For companies, the mechanism is straightforward: fewer separations mean fewer backfills, less recruiting and training spend, steadier staffing, and better service levels, i.e. hard savings that accrue to the P&L rather than soft, reputational gains.

3. Governance Materiality

Governance materiality encompasses corporate governance structures and ethical business conduct. Deficiencies such as lack of board diversity and transparency can lead to suboptimal decision-making, scandals, and erosion of investor trust. Corruption and fraud expose organizations to legal penalties, financial losses, and reputational damage.

Strategic Response: Companies must expand their governance frameworks to address emerging risks, including privacy and cybersecurity threats in the evolving IT landscape. For example, developing solutions to counteract generative AI-driven deepfakes is becoming increasingly important.

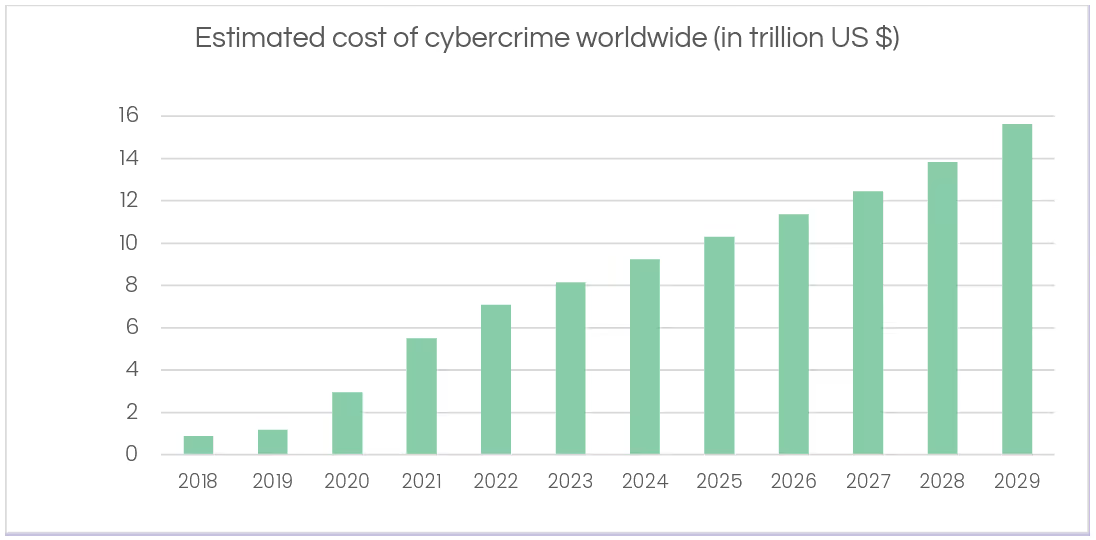

Material Example: The human dimension of cybersecurity risk management is undergoing profound structural transformation and a prime example, driven largely by the rapid advancement of generative artificial intelligence (GenAI). These technology advancements fundamentally alter the threat landscape by enabling attackers to orchestrate highly sophisticated, scalable, and adaptive attacks. The result is not merely an incremental escalation in risk, but rather a step-change in both the frequency and severity of successful breaches.

Traditionally, employee training has focused on recognizing standardized, low-quality phishing attempts – often generic emails riddled with spelling errors or suspicious links. However, this paradigm is quickly becoming obsolete. In the near future, phishing attacks will be characterized by highquality personalization and simultaneously distributed across multiple channels: email, phone, instant messaging, and even video calls. This multivector sophistication implies that employees will face attack scenarios far beyond their current training and preparedness.

The cost implications of failing to adapt are considerable. As cybercriminals deploy increasingly convincing tactics, global losses from cybercrime are projected to rise sharply in the coming years.

This surge reflects not only higher-quality attacks but also a pronounced increase in sheer volume, with organizations now facing an unprecedented number of weekly intrusion attempts.

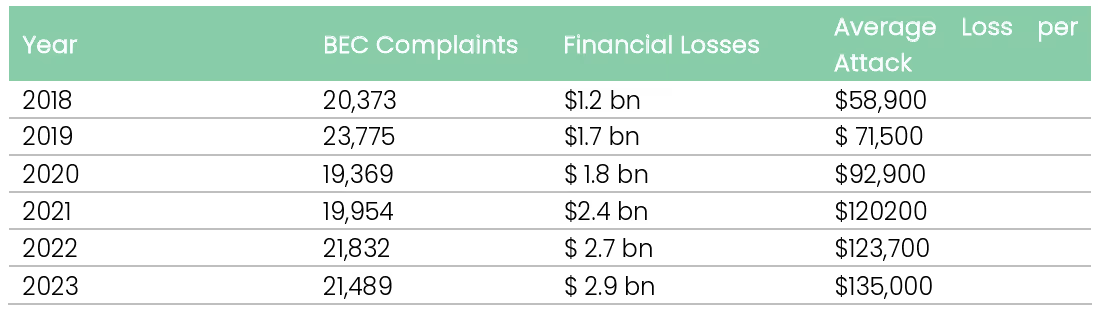

The statistics reinforce this trend. Although the baseline number of successful attacks via traditional email phishing has remained relatively stable, the financial impact continues to climb annually. For example, business email compromise (BEC) incidents in the United States translated into steadily mounting losses – from $1.2 billion in 2018 to $2.9 billion in 2023. Over the same period, average losses per attack more than doubled, reaching $135,000.

The implication is unambiguous: firms must train employees to detect and neutralize emerging threats to sustain resilience amid persistent attacks. Organizations that do so not only uphold responsible governance but also materially reduce the likelihood and cost of successful cybercrime— delivering a clear return on investment in employee-based cybersecurity training.

The Deregulation Paradox: How reduced oversight leads to greater disorder and increases the need for Software

Historically, many ESG software solutions have focused on helping companies meet regulatory reporting requirements, often positioning themselves as alternatives to traditional consulting services. The primary business case has centered on compliance, enabling organizations to fulfill legal obligations, avoid penalties, and satisfy external demands. In this environment, companies have typically done just enough to meet minimum standards, with little incentive to go beyond what regulations require.

The Impact of Deregulation: However, if regulatory and customer pressures diminish, the compliance-driven rationale for ESG spending weakens. Companies may be tempted to scale back their investments in compliance initiatives, viewing them as optional rather than essential. At first glance, this suggests a reduced need for ESG-related software.

The Paradox: Why Less Regulation Means More Software

Yet the reality is more complex. With less regulatory guidance and oversight, companies face greater uncertainty and variability in how to address ESG issues, especially those that are materially significant to their business. Without clear rules, organizations must decide what is material, how to measure it, and how to communicate it to stakeholders such as investors, customers, lenders, and platforms. In practice, one of two things happens: firms deploy more tools to navigate a fragmented set of expectations, or industries converge on de facto standards coordinated by self-regulatory organizations (SROs) industry bodies that set and sometimes enforce common protocols or best practices. In both cases the burden shifts from statute to systems, and the need for software does not diminish; it increases, because companies still have to prove what they do with workflows, controls, evidence, and attestations both to mitigate long-term risk and to avoid losing business where demonstrable conformance is a condition for market access.

Companies need robust tools to:

- Identify and prioritize material ESG issues relevant to their industry and operations

- Collect, analyze, and report data in the absence of standardized frameworks

- Monitor evolving stakeholder expectations and market trends

- Demonstrate value creation and risk mitigation beyond mere compliance

The Future: Materiality-Driven Software Solutions

The future of sustainability will not be written in compliance manuals but in material solutions. This dynamic will become even more pronounced in a deregulated environment, as the emphasis shifts from box-ticking compliance to strategic management of material sustainability topics. Companies themselves must define what is materially relevant, measure it credibly, and embed it into their core strategy. In this context, software becomes indispensable — not as a reporting afterthought, but as a strategic enabler of resilience, competitiveness, and innovation. Less regulation does not reduce the need for ESG technology; it amplifies it.

At the same time, the shift crystallizes the centrality of materiality. Superficial sustainability gestures will not survive. What matters are the sustainability factors that directly shape costs, revenues, risks, and opportunities. Materiality-driven strategies link sustainability to financial performance by reducing risk exposure, stabilizing cash flows, and unlocking new growth areas.

The opportunity set is broad. Decarbonization, climate mitigation & adaptation, circular economy models, and grid resilience remain critical environmental frontiers. In parallel, material social issues — such as worker well-being and financial health of lower-income consumers — and governance challenges — from cybersecurity to AI-driven model risk — are becoming decisive for long-term value creation. Firms that integrate these material approaches into their strategy, enabled by robust software solutions, will not only fulfill regulations but rather gain a durable competitive edge.

At Cusp Capital, we see this convergence of materiality sustainability and digitization as the next great wave of sustainable value creation. The pendulum of attention may continue to swing, but the fundamentals are unshaken: material sustainability is structural, not cyclical. The leaders of the next decade will be those who treat sustainability not as a reporting burden, but as a blueprint for innovation — and who leverage software as the catalyst that translates sustainability into lasting advantage.

1 The study also pinpointed countries where average employment tenure is lengthening — Lithuania (+2.5 yr), Luxembourg (+1.5 yr), Slovak Republic (+1.3 yr), Bulgaria (+0.9 yr), Latvia (+0.8 yr), Slovenia (+0.7 yr), Czechia (+0.6 yr), and Greece (+0.5 yr).

2Comprehensive details are presented in the table in the appendix.

3ESG-in-CAPM is a useful mental model; while beta-lowering and cost-of-capital effects may not yet be fully priced due to evolving investor recognition, ongoing improvements in ESG data quality are likely to enable more complete market incorporation.

.jpg)

.jpg)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)